Introduction:

ITR Filing Last Date 31st July is approaching fast. Filing income tax returns (ITR) is a crucial responsibility for individuals in India. It is not only a legal obligation but also an opportunity to assess one’s financial standing, contribute to the nation’s development, and reap various benefits. In this blog, we will explore income tax return filing in India and shed light on its significant advantages.

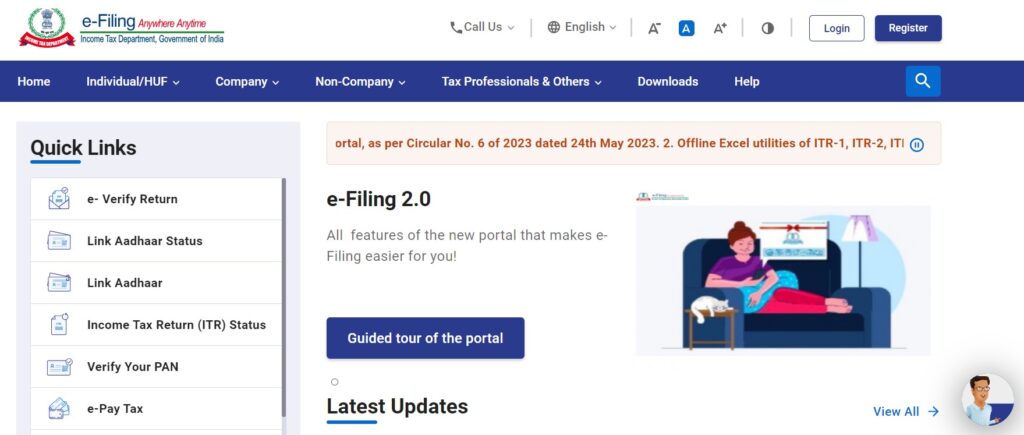

Itr can be filed on official government website before ITR Filing Last Date at https://www.incometax.gov.in/iec/foportal/

What is Income Tax Return Filing?

Income tax return filing refers to the process of reporting your income, expenses, investments, and taxes paid to the government for a specific financial year. The Income Tax Department of India uses this information to assess the taxpayer’s liability and determine any tax refunds.

Benefits of Filing Income Tax Returns:

Let’s delve into the benefits individuals can enjoy by filing their income tax returns in India:

a. Compliance with the Law:

Filing income tax returns is mandatory for individuals whose income exceeds the basic exemption limit set by the government. By fulfilling this legal obligation, individuals demonstrate their commitment to following the tax laws and regulations.

b. Claiming Refunds:

One of the significant advantages of filing income tax returns before ITR Filing Last Date is the possibility of receiving tax refunds. If the tax deducted at source (TDS) exceeds the actual tax liability, individuals can claim a refund after filing their ITR. This ensures that individuals receive the excess tax amount back in their bank accounts, improving their financial position.

c. Financial Documentation:

ITR serves as an essential financial document. It acts as proof of income, which is crucial for various purposes such as obtaining loans, applying for visas, or acquiring assets. Having a clean and accurate ITR record enhances an individual’s credibility and financial reputation.

d. Carry Forward of Losses:

Filing ITR enables individuals to carry forward losses incurred in a financial year if filed before ITR Filing Last Date. These losses can be set off against future income, reducing the tax liability in subsequent years. This provision provides individuals with flexibility and helps them optimize their tax planning strategies.

e. Loan Application:

Financial institutions often require ITR documents when considering loan applications. By filing ITR regularly and maintaining a clean tax record, individuals enhance their chances of obtaining loans at competitive interest rates. It showcases their financial stability and repayment capacity to lenders.

f. Visa Processing:

When applying for visas, especially for foreign travel, many countries require individuals to submit their ITR documents. A consistent record of filing ITRs demonstrates an individual’s financial stability and validates their ability to support their travel expenses, strengthening their visa application.

g. Avoiding Penalties:

Non-compliance with income tax laws can lead to penalties and legal complications. Filing income tax returns within the ITR Filing Last Date ensures individuals stay on the right side of the law and avoid unnecessary fines or legal proceedings.

Conclusion:

Income tax return filing in India is not just a legal obligation but also a means to enjoy several benefits. From claiming refunds to building a strong financial profile, filing ITRs plays a vital role in an individual’s financial journey. By understanding the importance and advantages of income tax return filing, individuals can proactively fulfill their tax obligations, contribute to the nation’s progress, and secure their financial well-being.

Key Benefits of Income Tax Return Filings (ITR)

- Avoid Fine & Interest if filed before ITR filing last date

- Banks demands last three years ITR for any loan

- ITR Need in Visa Processing

- A valid legal document for income proof

- For getting a plan ITR is needed

- Get your refund of TDS deducted

- TDS deduction at normal rates

- ITR filed on or before last date can carry forward the losses

- You can carry forward the losses from F&O Business also.

Hope you like the above post. Please share.

Thanks & Regard!

CA Gopal Kumar

9718569879

cagkumar1@gmail.com